Cards In This Set

| Front | Back |

|

Simple Interest

|

|

|

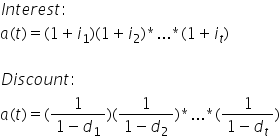

Compound Interest

|

|

|

Accumulation Function

|

The accumulated value of the fund at time t of an initial investment.

|

|

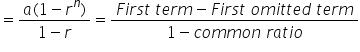

Sum of a Geometric Progession

|

|

|

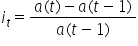

Effective Rate of Interest

|

Regular i. Tells us how fast a fund is growing based on the amount in the fund at the beginning of the year.

|

|

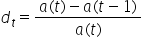

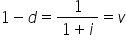

Effective Rate of Discount

|

Regular d. Tells us how fast a fund is growing based on the amount in the fund at the end of the year.

|

|

Present Value

|

Amount at time 0. How much should we invest today in order to have a given amount at the end of t years?

|

|

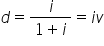

Discount to Interest Relationship

|

|

|

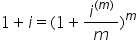

Nominal Rate of Interest

|

Cannot be directly used to calculate. "compounded" & "convertible". First we convert according to the number of compounding periods.

|

|

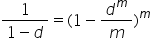

Nominal Rate of Discount

|

Cannot be directly used to calculate, we need to convert to an effective rate.

|

|

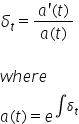

Force of Interest

|

Rate of growth at any time**U-substitution**variable means integrate from a to b**

= =  |

|

Constant Force of Interest

|

..

|

|

Time Value of Money

|

Always use a common comparison date

|

|

Equation of Value

|

?

|

|

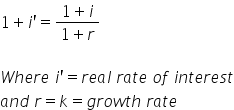

Inflation

|

..

|